Max Fsa Contribution 2025 - Fsa 2025 Eligible Expenses Bella Carroll, The irs confirmed that for plan years beginning on or after jan. Amounts contributed are not subject to federal income tax, social security tax or medicare tax. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions.

Fsa 2025 Eligible Expenses Bella Carroll, The irs confirmed that for plan years beginning on or after jan. Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

For 2025, the maximum an employee can contribute to their fsa is set at $3,200 ($6,400 per couple). Keep reading for the updated limits in each category.

The IRS Just Announced the 2025 Health FSA Contribution Cap!, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. What is the 2025 maximum fsa contribution?

2025 Contribution Limits For The TSP, FSA & HSA YouTube, For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

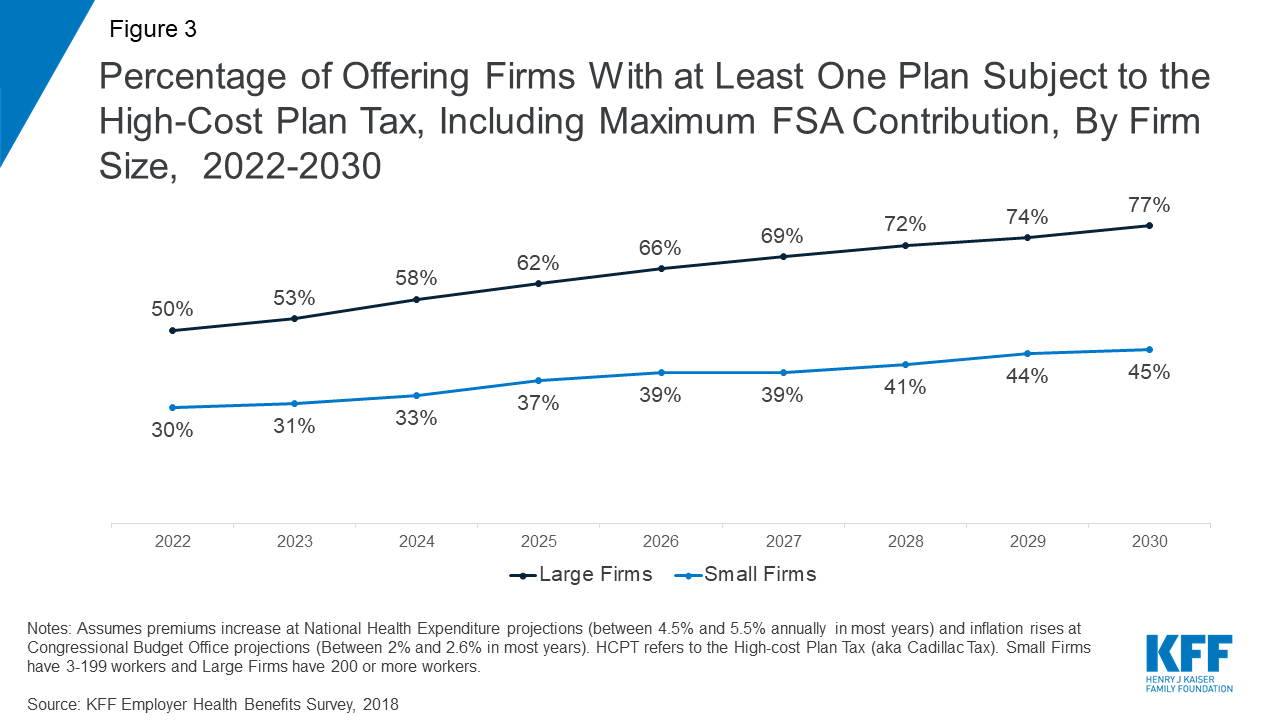

How Many Employers Could Be Affected by the HighCost Plan Tax KFF, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions.

Max Fsa Contribution 2025. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in.

Maximum Hsa Contribution 2025 Lisa Renelle, Each year, the irs sets the contribution limits for individuals opening an fsa. Here, a primer on how fsas work.

Maximum Defined Contribution 2025 Sandy Cornelia, The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2023) employers may impose. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

Max Flexible Spending Account 2025 Nissy Andriana, Employees can now contribute $150 more. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

Can Both Spouses Have An Fsa 2025 Tarah Francene, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). The irs confirmed that for plan years beginning on or after jan.